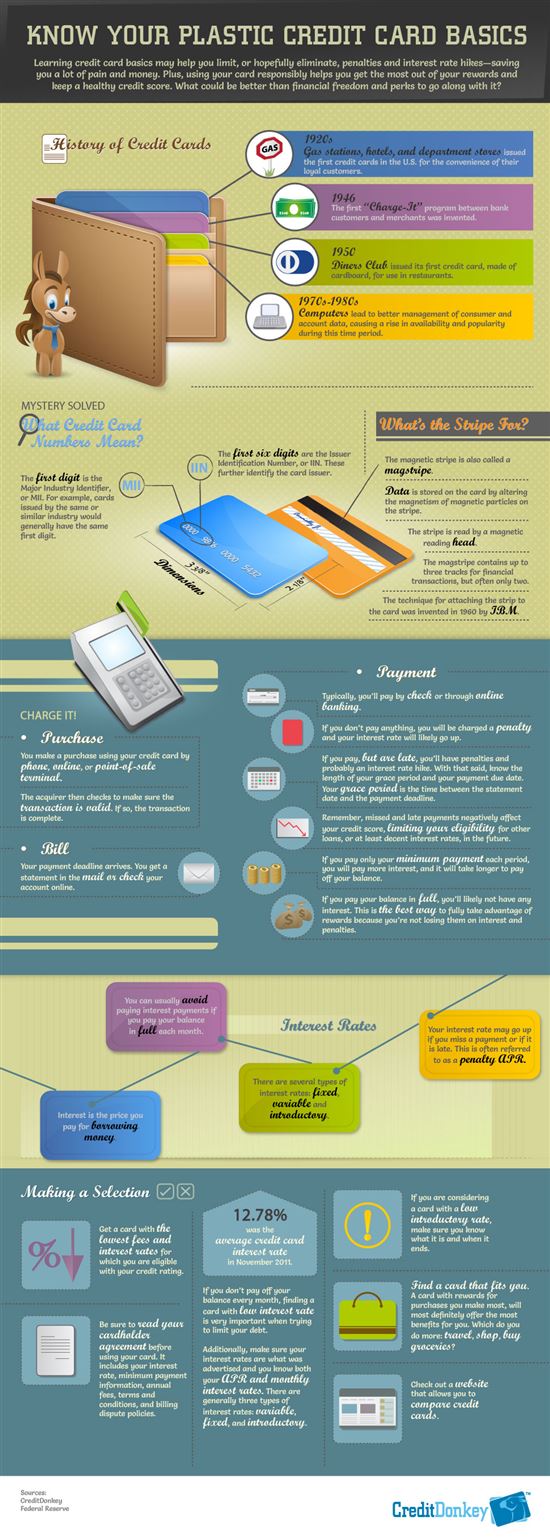

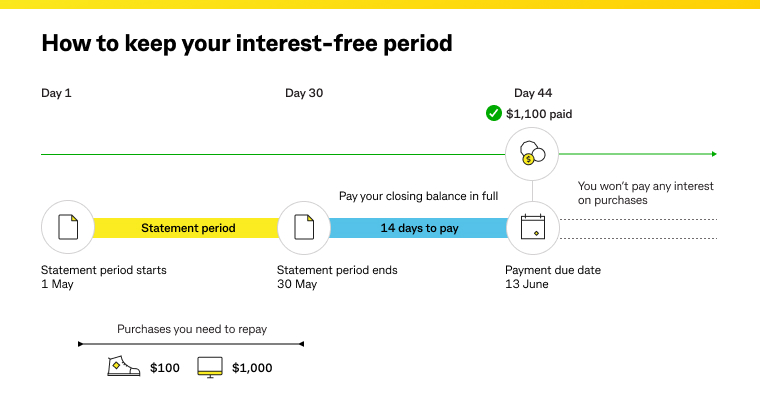

If you were told that you do not have to pay interest on the purchase if the purchase is paid in full within 12 months your card has a deferred interest plan. It is mandatory for every credit card issuer to disclose or reveal the fees involved with the.

What Is Credit Card Apr How Yours Affects You Mintlife Blog

How Credit Cards Work Credit Cards For Beginners

How Does Credit Card Interest Work Experian

0 interest credit cards balance transfer credit cards To view more research from the Bankrate team visit our credit card statistics center.

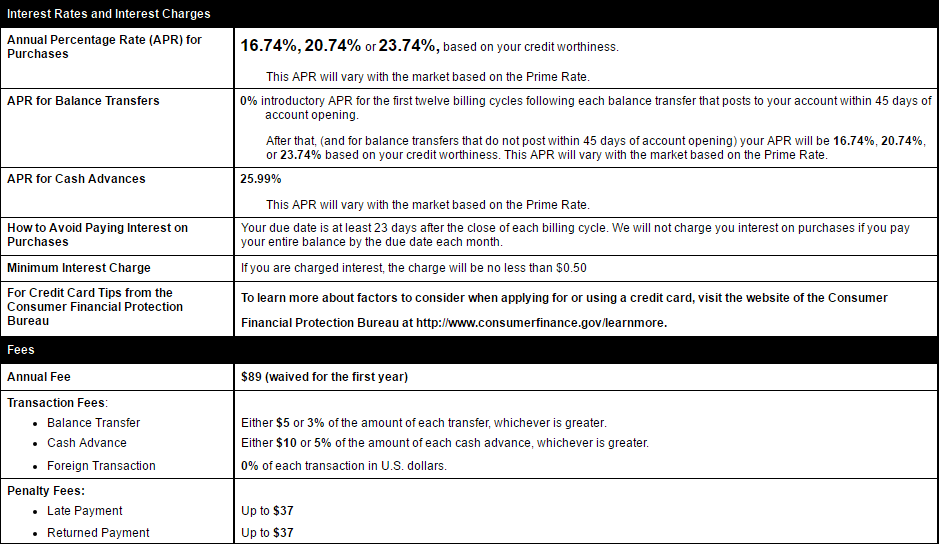

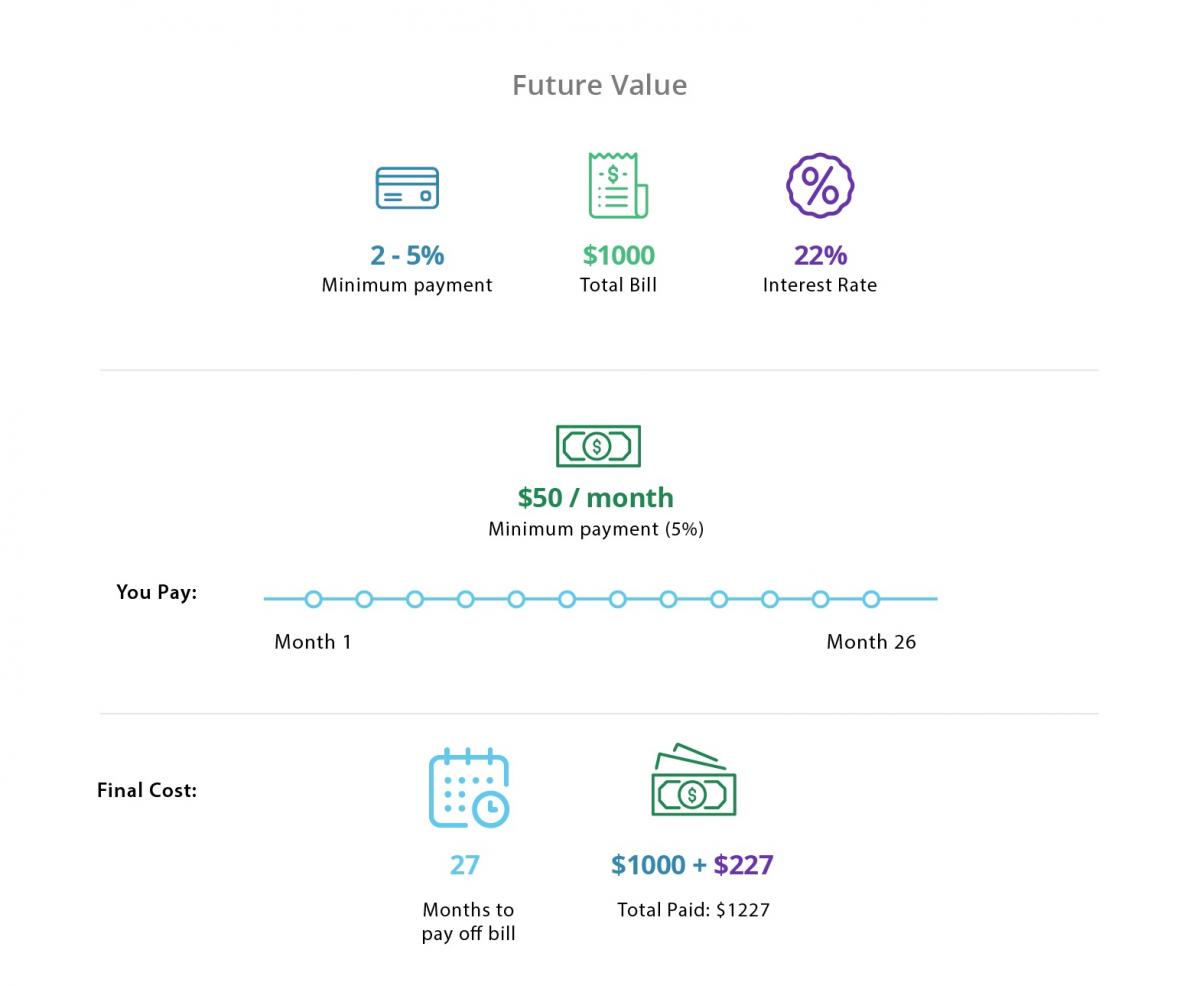

How does the interest rate work on a credit card. This may allow you to consolidate your existing balances from multiple cards onto a single new card. With average credit card interest rates currently ranging from about 13 to 23 interest charges can add up fast. How does the interest rate on a credit card work.

In this example the credit card uses a 360-day year some cards use 365 terms will vary so the daily percentage rate or DPR is equal to 25 360 or 06944. For example if your card has an APR of 16 the daily rate would be 0044. Consider a balance transfer credit card instead.

Business and student credit cards typically have the lowest interest rates while store credit card rates are usually higher than average. The average interest rate for a credit card is about 20 so this may serve as a guidepost for comparing credit card offers. With a fixed-rate HELOC you can withdraw as much or as little of your credit line as needed.

It works as a daily rate calculated by dividing your annual percentage rate by 365 and then multiplying your current balance by the daily rate. To illustrate the three-step process for calculating your interest charges imagine that you have an outstanding balance of 3500 on a credit card with an interest rate of 25 percent. Once you achieve the credit score you desire and pay off the remaining balance you can reach out to your financial institution to go over the next steps including the chance to apply for a regular credit card.

The card company takes that rate and adds several percentage points ie. I got a credit card promising no interest for a purchase if I pay in full within 12 months. The main goal of using a secured credit card is to improve your credit score to a more comfortable level in order to then qualify for a normal non-secured credit card.

If your credit card has an annual percentage rate of say 18 that doesnt mean you get charged 18 interest once a year. A fixed interest rate doesnt fluctuate in connection with the prime rate or other index rates that change from time to time but that doesnt mean fixed rates are set in stone. Balance transfer cards may provide you an alternative for getting a lower interest rate on your current credit card debt.

How does this work. Credit card interest is what you are charged when you dont pay your credit card bill in full each month. Thats why it may be a good idea to get your interest rates lowered if you can.

When you make a purchase using your credit card your lender pays the merchant upfront for you. If you had an outstanding balance of 500 on Day One you would incur 022 in interest that day for a total of 500. For example a card may advertise a 1399 to 2299 APR depending on your creditworthiness.

When a cards APR is divided by 12 to get a monthly rate and that rate is multiplied by an accounts average daily balance it results in the interest charges that must be paid when cardholders carry a balance on their credit card. Treasury Bills the Federal Reserve Discount Rate or other indexes. Interest is compounded on the outstanding balance on a daily basis.

Your interest rate may be expressed on your statement as APR or annual percentage rate. To get a lower interest rate on your credit cards follow the steps below. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed.

Unlike a variable-rate HELOC the interest rate on any amount you use will have the same interest rate. Besides charging a higher-than-normal interest rate credit card companies also automatically charge a transaction fee on the advanced sumfor. So if your card has a 1599 APR your DPR would be 00438.

The reason why credit card balances can quickly build up on cards with high APRs is because of compounding interest charges that occur on a daily basis. Yes opening a new card might impact your credit score and there may be a balance fee involved but in the long run your score and your own financial well-being may benefit from nipping that interest rate in the bud. Steps to performing a balance transfer.

As the Consumer Financial Protection Bureau CFPB explains interest is the cost of borrowing money from a lenderInterest is typically shown as an annual percentage rate or APRFor credit cards the APR and interest rate are usually the same. Therefore this fee differs from one credit card issuer to the other. Variable-rate plans have their interest charges based on benchmarks such as the prime interest rate interest on US.

Depending on how you manage your account your effective interest rate. Heres how fixed rates work and how they can affect how much you pay for your loan. Apply for a balance transfer credit card with a zero or low-interest promotional period.

This may have changed since you first signed up for the card so check your latest statement for the current rate. This means that at the end of each day the interest rate is calculated for the day based on the amount that stands unpaid on your account at the end of the day. Enter the percentage interest rate without adding a percent sign.

Your final APR would fall somewhere in that range based on your credit score and other risk factors. Enter the current interest rate charged by your credit card. Credit card issuers disclose a range of potential interest rates with each credit card offer.

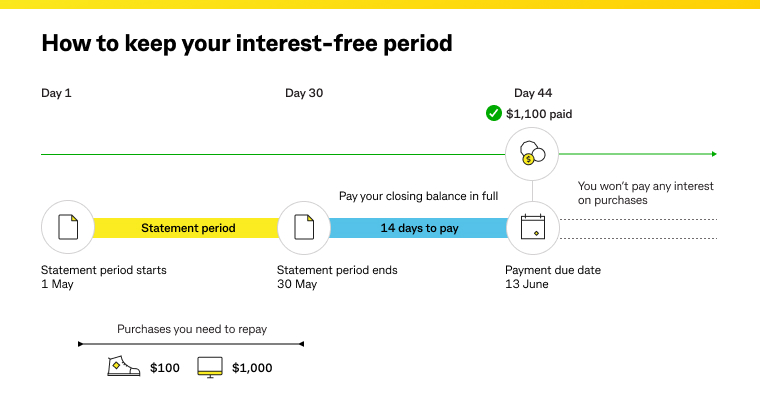

Look for a card with a low interest rate a decent number of interest-free days and low or zero annual fees. Other credit card options. The average credit card interest rate is 1824 for new offers and 1454 for existing accounts according to WalletHubs Credit Card Landscape ReportIt is best to avoid carrying a balance from month to month with a credit card if the APR is anywhere close to the current average.

You may also like. However most credit card companies add an extra percentage on it making the fee range from 15 to 3 or even more. Credit card interest is a way in which credit card issuers generate revenueA card issuer is a bank or credit union that gives a consumer the cardholder a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously.

When it comes to selecting and using a virtual credit card the same rules of thumb apply that work for regular plastic cards. Thats calculated by taking your credit cards Annual Percentage Rate APR and dividing it by 365 for all the days in the year.

How Credit Card Interest Rates Is Calculated On Dues Exitten

How To Compare Apply For Use Your First Singapore Credit Card Moneysmart Sg

How Does Credit Card Interest Work

What Is Apr On A Credit Card And How Does It Work Citizens

Credit Card Definition Meaning Investinganswers

Chart Credit Card Interest Rates Keep Climbing Statista

5 Ways To Calculate Credit Card Interest Wikihow

Apr Vs Interest Rate Surprising Differences Between The Two Numbers