Whole life insurance offers consistent premiums and guaranteed cash value accumulation while a. Once you buy a whole life policy its insurance for life and the life insurance rate you pay is guaranteed to stay the same even as you age or your health status changes.

Best Whole Life Insurance Singapore 2021

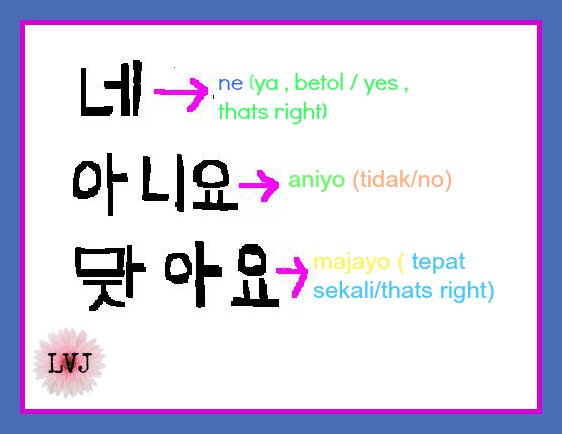

Whole Life Insurance Definition

Working Adult Guide Term Life Or Whole Life Insurance Which Should I Get

The applicable tax law is complex.

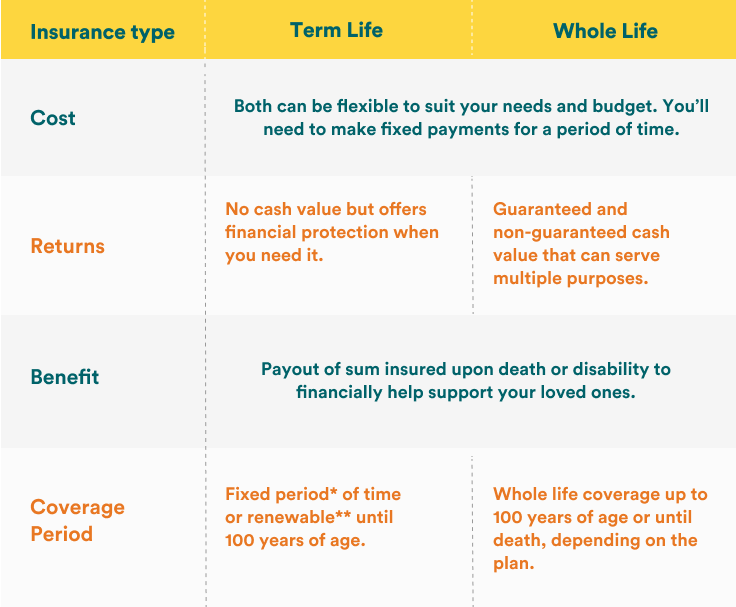

Whole life insurance. 2 Certain product designs combine term insurance and whole life insurance and may be subject to premium increases. A whole life insurance policy provides coverage for your entire life as long as you pay your monthly premium compared to term life insurance which protects you for only a specified period of time. The following sample whole life insurance quotes are based on a preferred plus male wanting ordinary whole life insurance to age 100 with an A rated insurance company or better.

Life insurance can help you do that. Designed with affordability in mind a DreamSecure whole life insurance policy is a simple convenient way to help you protect your familys future. The premiums you pay for the policy can give you access to cash value while youre living 3.

Whole life and universal life insurance are both types of permanent life insurance. Whole life insurance performance is highly dependent on dividend rates. The contents of this document are not intended to be and are not legal or tax advice.

1 The claim to providing coverage for your whole life assumes that all premiums are paid. Whole Life Insurance also known as permanent insurance provides death benefit coverage for the policy owner throughout their life. Permanent life insurance is different than term life insurance which covers the insured person for a set amount of time usually between 10 and 30 years.

This can help you understand where each company ranks historically. Whole and term life are the most common typesand each has its benefits. For a healthy 40-year-old the typical cost of a 500000 whole life insurance policy is 5728 a year according to average life insurance rates from Quotacy a life insurance brokerage.

With whole life insurance youre guaranteed a death benefit and youre able to build up cash value over time. Whole life insurance is a type of permanent life insurance that provides lifelong coverage with a guaranteed rate of return and premiums that are typically locked-in as long as all premiums are paid on time. Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

As long as the policy owner meets his or her obligations under the policy the policy remains in force regardless of any changes in health that may occur. Consistent cash value growth Your whole life insurance policy receives a guaranteed fixed rate of interest on the cash value. Whole life insurance is typically more expensive than term life policies but the premium amount is fixed for the life of the policy.

It builds cash value tax-deferred and the proceeds of the death benefit are passed to your beneficiaries free from federal income tax. Locked-in payments are established at the start of the policy and as long as all premiums are paid on the predetermined schedule Whole Life Insurance policies are designed to last a. It can provide coverage that can last your entire life and doesnt require renewal as long as you make regular payments called the premium 2.

Whole life insurance policies offer two primary benefits. Universal life insurance ULl is a relatively new insurance product intended to combine permanent insurance coverage with greater flexibility in premium payments along with the potential for greater growth of cash values. Whole life insurance is a type of permanent life insurance that offers cash value.

3 Your policys cash value typically becomes a useful source of funds only after several years of premium payments which allows the cash value to build up. Whole Life Insurance sometimes called permanent insurance or ordinary life is designed to stay in force throughout ones lifetime. Icons representing life insurance products are broken out into four simplified term life term life flexible life and whole life.

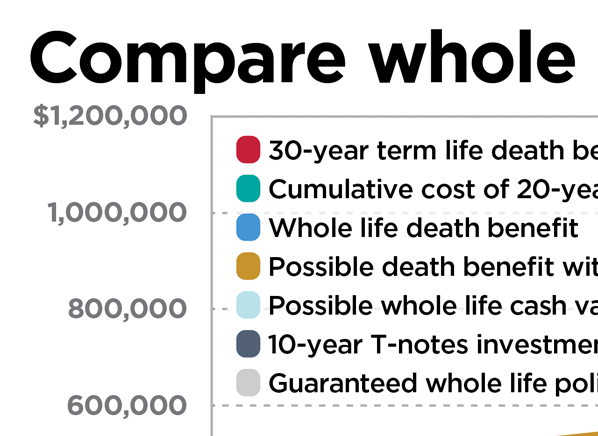

We also go back to give you average rates for the past 5 10 15 and 20 years. When youre thinking about your familys finances ensuring that your income is protected now and in the future is important. Take a look at how term and whole life compare.

What is whole life insurance. Whole life insurance is for those looking for lifetime protection with added benefits. In addition to providing a guaranteed life insurance benefit it also offers an important way to save for the future helping you to be prepared for whatever lies ahead.

Whole Life Insurance Dividend Rate History. The selling of a life insurance policy by a terminally ill person so that person can receive a benefit from the policy while still alive and the purchaser of the policy can receive a. Plus whole life insurance has tax advantages.

In addition you have the opportunity to earn dividends 2 which are not guaranteed. A guaranteed death benefit paid to your beneficiaries when you pass away as long as you continue to pay the premium and a cash value that can be withdrawn or borrowed from during your lifetime. These policies allow you to build up cash that you can tap into while youre alive.

What is a whole life insurance policy. So we wanted to have an updated list of Whole Life Insurance Dividend History. It also provides guaranteed cash value that you can access at any time for any need including funds to help pay for college cash to support your business or income in retirement.

Its permanent life insurance. Whole life insurance is defined by the following three factors. The guaranteed death benefit can help replace a familys loss of income help with mortgage costs or educational needs or to leave a legacy for the next generation.

A whole life insurance policy also offers a savings component that enables the policy to build cash value. Whole life policies also grow cash value at a set rate which can be borrowed against for future needs. The cash value portion of your policy grows tax-deferred.

So in that way it can be seen as a kind of investment as well as a way to provide for loved ones after the die. Monthly Rates are for informational purposes only and must be qualified for. Whole life insurance works by creating an immediate guaranteed death benefit with permanent coverage as long as required premiums are maintained.

Whole life insurance provides lifetime coverage for a set premium amount. Whole Life Insurance can have fixed-rate payments that can be made on a monthly quarterly semi-annual or annual basis. Whole life insurance is a type of permanent life insurance which means the insured person is covered for the duration of their life as long as premiums are paid on time.

Whole life insurance is the most common type. Whole life insurance helps your family prepare for the unexpected. Many people decide that a combination works best.

Whole life insurance can help protect your spouse during retirement or become a legacy for your loved ones or a favorite charity.

What Is A Whole Of Life Insurance 2021

1

Term Vs Whole Life Insurance Pros Cons To Help You Decide

Is Whole Life Insurance Right For You

Whole Life Insurance Definition And Meaning Market Business News

Whole Life Or Term Life Insurance Better For You Fwd Singapore

Whole Life Insurance Insurance Pro Florida

Whole Life Insurance Vs Term Life Insurance Top 4 Amazing Differences